Contact us

Contact us

Chinedu took a loan from Kola and promised to pay it back in 2 weeks. Two weeks came and passed, and Chinedu did not pay it back. Upset that Chinedu defaulted, Kola reached out to him to ask for an update.

Chinedu apologises for the delay and promises to pay the following week. However, Chinedu could not understand why Kola felt upset; after all, they were friends, and he was not going to abscond.

Was Kola right to be upset with Chinedu?

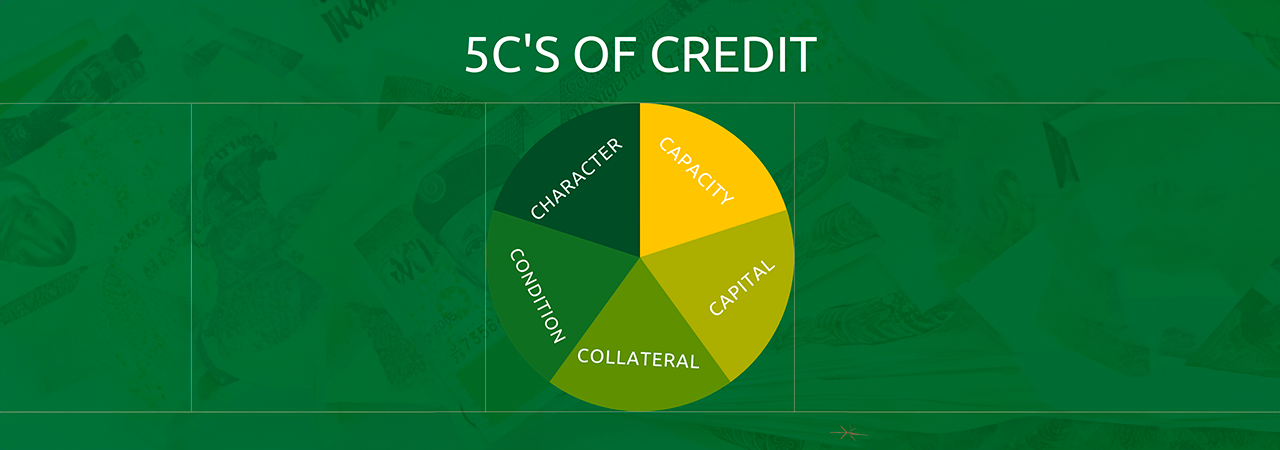

This takes us to the 5Cs of Credit – a system often used by lenders to measure the creditworthiness of potential borrowers. It is about estimating the chances of default by borrowers and, consequently, the risk of a financial loss for the lender.

The 5 Cs of credit are CHARACTER, CAPACITY, CAPITAL, COLLATERAL, and CONDITIONS.

CHARACTER: This can be defined as the borrower’s reputation or track record for repaying debts. This information appears on the borrower’s credit reports generated by the credit bureaus.

The general rule is that the higher a borrower’s credit score, the higher the likelihood of loan approval. Borrowers with an excellent credit score will also have access to higher loan offers than those with a lower credit score.

CAPACITY: Capacity measures the borrower’s ability to repay a loan by comparing income against recurring debts. It comes down to how much money you make and how much debt you owe.

The lower an applicant’s Debt-To-Income ratio (DTI), the better the chance of qualifying for a new loan.

CAPITAL: Lenders also consider the borrower’s capital invested into a business. A substantial financial contribution to a business investment by the borrower decreases the chance of default. This makes decision-making easier for lenders in terms of loan disbursement.

COLLATERAL: A borrower with the right collateral will find it easier to access a loan than a borrower without collateral. Collateral assures the lender that if the borrower defaults on the loan, the lender can get something back by repossessing the collateral.

Loans backed with collateral are sometimes called secured loans because they are less risky for lenders to issue.

CONDITION: Lastly, one of the metrics Lenders consider is the conditions surrounding the loans. This may include the length of time an applicant has been employed at their current job, how well the industry has performed, and future job stability.

For business loans, conditions may include how a borrower intends to use the loan or the type of business the fund will be invested into. This may also include the amount the borrower is asking for and the interest rates.

If Borrowers can make use of the information highlighted above, their credit score will increase and it will be easier to access higher loans when they repay the previous loans.

Advans Nigeria is the best of all the microfinance banks in Nigeria in terms of loan offers with low-interest rates and an easy repayment structure.

Call 07000238267 or WhatsApp 08151770000 for more information.